The Ultimate China E-Commerce Marketing Calendar

China’s shopping festivals can make or break your year. That’s because they aren’t just about getting a good deal. Some are testing grounds for bigger events and even minor holidays can supercharge product listings, help increase visibility in search while also propping up revenues in an otherwise ho-hum month.

Of course, occasion marketing is popular outside China. But it is limited to Hallmark holidays such as Valentine’s Day or major discount events like Black Friday (Black Friday results are seen as a bellwether for retailer health in the USA.)

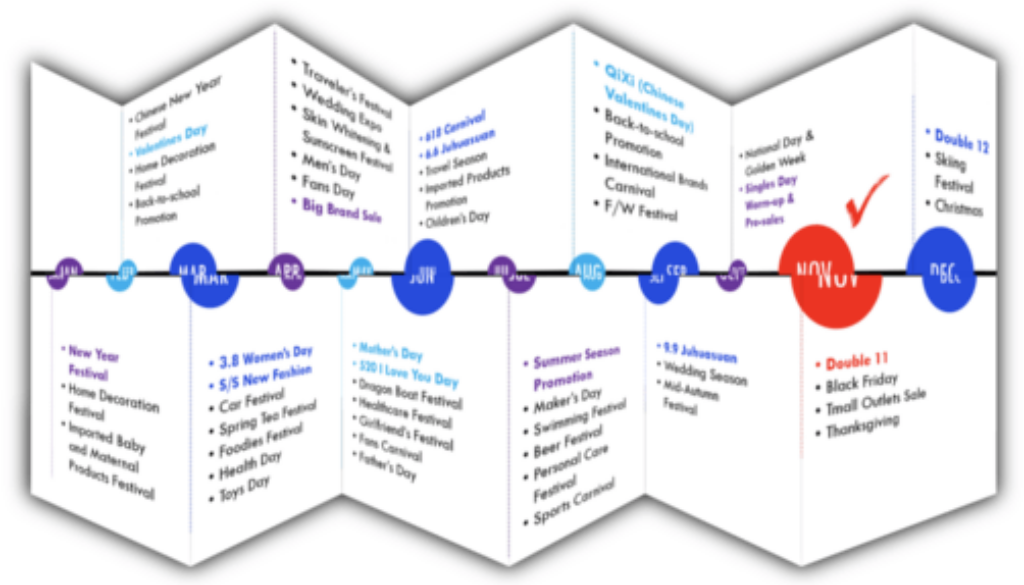

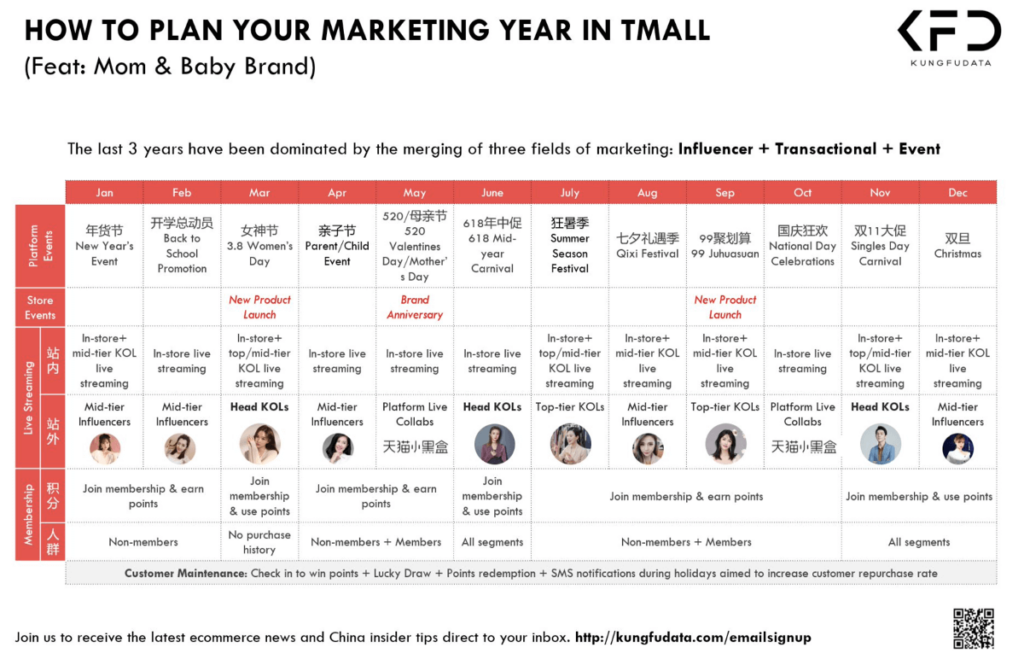

The situation in China, however, is more intense and competitive. A standard marketing calendar for any Tmall or JD store includes most shopping festivals abroad plus a huge range of local festivals along with category specific and seasonal pop up events.

Tmall and JD are hell bent on enticing every consumer and every merchant to jump on the event band wagon and run promotions – all year long. Stimulating consumption for any reason whatsoever seems to be the Modus Operandum of every big ecommerce platform in China. This is as true for Tmall and JD as it is of upstart Pin Duo Duo, which has carved out a niche in group and community buying in lower tier cities, and Douyin, China’s Tik Tok.

As Tmall and JD partners, we (Kungfu Data) are bombarded constantly with invitations to join new events (it’s exhausting). After attending so many, we’ve realized that four matter most. So the good news is that as a new brand entering Tmall, Tmall Global or JD (or ever RED and Douyin) for the first time, you can FOCUS your resources on the following:

3.8 (March 8th) – Women’s Day, aka 三八节 (Sānbājié)

This is the first major event following spring festival, also known as Chinese New Year. The Chinese Communist government liberated Chinese women and made International Women’s Day an official holiday in the 1950’s. The local meaning of the event has evolved since then and is slightly different as individual achievements aren’t the focus.

Instead, it has become an occasion for men to express their love for women and pamper them in different ways. They buy presents for their mothers, wives and even daughters. Female employees get a half-day holiday which they use to shop, get spa treatments, enjoy fine dining or party. They indulge in their own personal luxuries and special experiences.

Brands that do well during Women’s Day also do well during 6.18 (June 18th) and 11.11 (November 11th), and as such this event is a leading indicator of annual performance.

6.18 (June 18th) Mid-Year Carnival

Originally created to commemorate the anniversary of the founding of JD.com (June 18), China’s second largest shopping festival is growing in importance and lasts three weeks. The warm up period is from May 1 to May 25 when the sale begins and it ends at midnight on June 18. During the early pandemic period, performance on 6.18 even eclipsed Singles Day in 2020. Since then, the GMV (gross merchandise volume) on every subsequent 6.18 has exceeded the prior year’s Singles Day results. Given Alibaba’s recent struggles with government intervention, 6.18 could unseat Singles Day as China’s largest shopping event. From a revenue standpoint, the period accounts for 15% of our annual GMV. For some of our clients with strong spring and summer collections, it is their biggest event of the year.

9.9 (September 9th) Juhuasuan

This is Alibaba’s 3rd most important shopping event. It originated as a wine and spirits festival because the Mandarin pronunciation for the 9th day of September sounds similar to the character used to describe all kinds of “liquor.” So successful, it was rolled out to all product categories and has since become a staging platform for Singles Day, where category managers, merchants and brands can test hero collections and “rank pump” prior to the Singles Day presale that begins in mid-October. Stores that perform well during 9.9 also perform well during Singles Day. There is a noticeable halo effect on forward sales.

11.11 (November 11th) Singles Day

The world’s largest shopping festival was launched by Alibaba’s CEO Daniel Zhang in 2009. It popularized a minor holiday celebrating China’s bachelors. “Bare sticks” is the Chinese slang for bachelor and has become synonymous with the numbers, “11.11” when spoken. This is the most important shopping event in the Chinese calendar. What was once a discounter’s dream is now a Hollywood marathon bursting with all forms of shopper-tainment. The gravitational pull of the event is so extreme it consumes all our resources from mid-October through late November. This mega shopping event accounts for more than 20% of our annual revenue. As such, careful planning for this event begins early in the first quarter. New stores need to be seasoned by August when Alibaba’s category team begins sending invitations. Brands that want to participate in the event must have enough inventory and promotional resources available by the end of September with cut off dates for inventory arrival no later than the first week of October. But decisions on key influencers must be made by late summer as availability is extremely limited due to higher and higher demand.

Important Notes:

While these events are unique to China, they have high strategic value to foreign brands hoping to do business here. It is quite common for new brands to launch during key events like Singles Day and 6.18 and be fully activated after the fact. Every event may not be appropriate (e.g. Women’s Day may not make sense for a men’s underwear brand) but by joining the biggest events and pushing resources into smaller events that have the most impact, you increase your chances for success dramatically.

Additionally, marketplace dynamics punish brands that don’t participate. If you opt out, you run the risk of irrelevancy, huge losses of sales and traffic (as high as 70%) and rank drops for your store and star product collections. Brands that do participate are able to raise the status and rank of individual product listings in the recommendation and search engine AI and put their stores front and centre with consumers. Opting out gives your competitors enduring advantages.